What we do

Notices

We want to make sure we are using the right information to contact you. If you have recently got a new e-mail address, mobile number or moved house, please let us know so we can better serve you with relevant Butterfield information and updates.

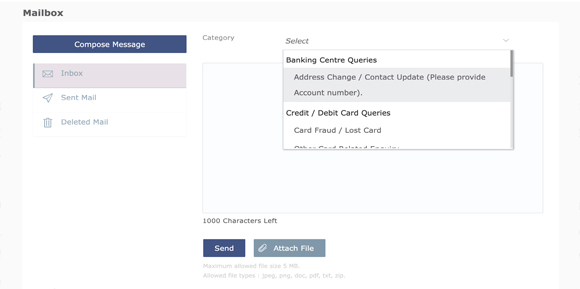

You can update us via Butterfield Online using your secure mailbox. This can be completed by navigating to your mailbox upon signing in. Click ‘Compose Message’ and select the first option from the drop-down category. Please include your account number as part of your submission:

Alternatively, you can complete this process in-person by visiting one of our Banking Centres.

We’re here to help. Our client services team can be reached at +1 (345) 949 7055 or [email protected] from Monday to Friday from 8:00 a.m. to 5:30 p.m. with the exception of public holidays.

Remember, Butterfield will never ask you to provide any personal information such as login credentials, PINs or one-time security codes over e-mail or via an SMS. Visit the Security & Fraud section of our website for more tips on how to protect your accounts.

Please be advised that effective 1 August 2023, Butterfield will no longer offer cheque encashment services to non-Butterfield clients.

If you would like to open a Butterfield Bank account, you can do so at any of our Banking Centres (via our Client Services Help Desk). Navigate to the Personal Banking tab for further details on the account opening process and to find related application forms.

Thank you for your co-operation.

In step with the recent reduction in the US Federal Funds Rate, Butterfield’s US and CI dollar prime rates for residential mortgages, consumer loans and corporate loans will decrease by 0.25% to 7.50% effective December 20, 2024.

Butterfield Visa Platinum Card Benefits Update

Auto Rental Insurance to be removed

Please be advised that effective 1 October 2021, Visa will discontinue Auto Rental Insurance1 as a benefit for the Butterfield Visa Platinum card. Visa will introduce new benefits in the future, at which time we will advise.

Cardholders who have used their Butterfield Visa Platinum card to rent at eligible auto rentals starting on or before 30 September 2021 will be covered by the current benefit. Auto rentals starting on or after 1 October 2021 will not be covered.

Additionally, effective 1 October 2021 a Travel Certificate2 must be generated prior to a trip in order for it to be covered under International Emergency Medical Services. An Extended Warranty certificate2 is also mandatory prior to opening a claim. These certificates can be generated through the Visa Benefits Portal at visa.com.

We apologise for any inconvenience this may cause.

1 Insurance is provided by AIG Insurance Co. Clients shall check the terms and conditions of each benefit to see applicable coverages for each card.

2 Generation of the Travel and Extended Guarantee certificates has been an existing mandate for Brazil since 2017, based on local regulations.

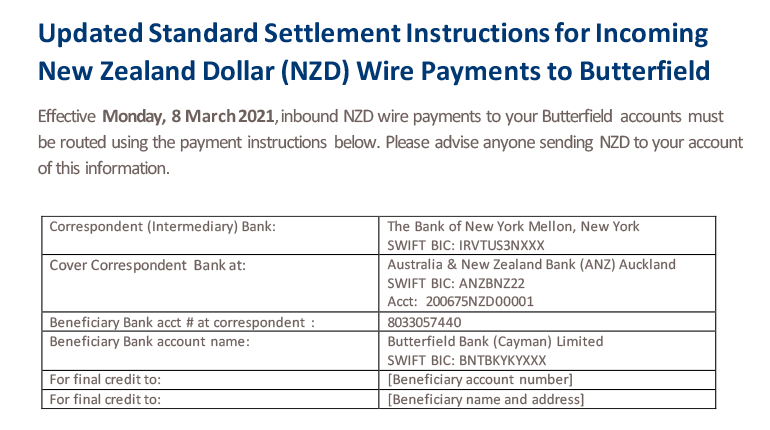

Body Updated Standard Settlement Instructions for Incoming New Zealand Dollar (NZD) Wire Payments to Butterfield. View International Money Transfers for more details.

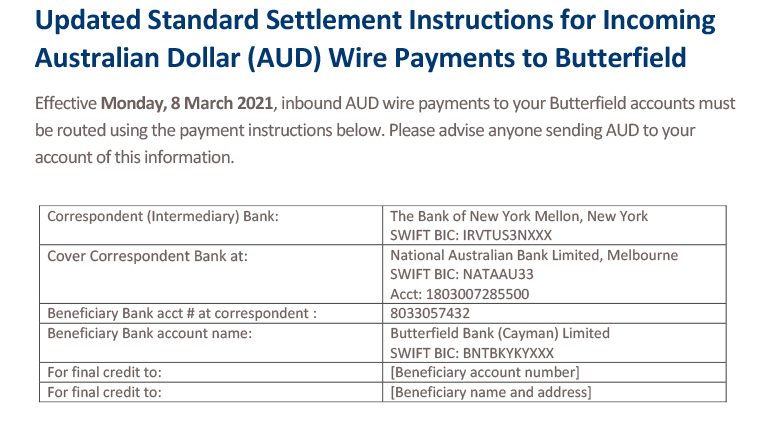

Updated Standard Settlement Instructions for Incoming Australian Dollar (AUD) Wire Payments to Butterfield. View International Money Transfersfor more details.

The global financial industry, including Butterfield is preparing to transition away from a key benchmark interest rate – the London Interbank Offered Rate, or LIBOR – to new alternative reference rates. Regulators have called for LIBOR to be replaced, with a transition period continuing in 2022, thereby allowing Butterfield time to engage with customers, who have credit / loan agreements that incorporate adjustable interest rates and LIBOR referenced as a benchmark.

Whilst the global LIBOR transition is an evolving process, Butterfield’s immediate response is to provide awareness of this process and thereafter ensure a smooth transition for customers. Therefore Butterfield has been orderly transitioning customers to alternate reference rates and these actions will continue for the remainder of transition period. Customer credit agreements are being reviewed to determine any requirement for amended contract language to incorporate a replacement rate.

Butterfield will be proactively contacting customers during the transition period to discuss the relevant approach. Importantly the Bank will be guided by industry language and regulatory standards to ensure customer consistency and fairness with the approach adopted.

To minimise future impact and disruption, Butterfield will no longer issue any new Credit Agreements that use LIBOR as a sole reference interest rate.

Should our customers have any questions regarding LIBOR transition or Credit Agreements, they should contact their Relationship Manager or the Client Services Team to discuss.

Butterfield is regulated in a number of jurisdictions - please click here for Legal & Regulatory information pertaining to Butterfield.